All articles

How Saving With Qapital Helped Me Quit My Job To Pursue My Dream

This guest post is courtesy of Kassondra Cloos.

Becoming a freelancer is the dream for a lot of writers, who love the idea of trying to make it as their own boss. I first started thinking about making the leap in 2014 when I was a newspaper reporter and not making very much money. I considered quitting to waitress, travel, and pursue creating writing. With tens of thousands of dollars in student debt, though, I needed guaranteed income.

But last year, while working as an editor for an outdoor industry news website—a dream job in itself—I became addicted to saving with the Qapital app, and I started thinking about it again as my savings grew. I had met lots of successful travel writers who told me going freelance was the best decision they’d ever made, and I started preparing to give it a shot.

In December, sick of throwing away all my spare cash on student loan bills, I cleared out my checking and savings accounts to pay off my highest-interest loans. There was a moment of intense freedom, then a few weeks of living paycheck-to-paycheck while I rebuilt my safety net.

I watched my spending closely, and I wanted to hold myself accountable for saving the money I’d no longer need for my loans.

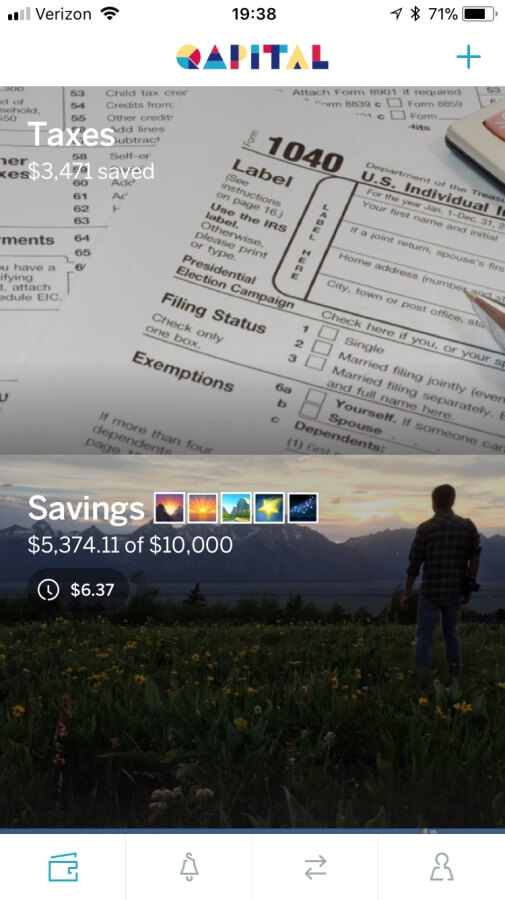

I found Qapital while Googling new savings accounts just after Christmas, and I opened an account immediately. I set up goals for student loans, quitting my job, and vacation, and a bunch of rules, like rounding up to the nearest $1 on every purchase, the 52-week rule (which saves $1 the first week then $2, then $3, and so on), and a guilty pleasure rule for withdrawing money from an ATM.

At first, I saved maybe $20 or $30 a week while I recovered from clearing out my funds to triple digits. But it quickly became like a game, and I created more and more rules. Automatic transfers held me accountable to save the $250 a month I had been spending on the loan I’d paid off, putting it just out of my reach so I couldn’t spend it frivolously. I loved how quickly spare change added up, so I took it a step further and changed my $1 round-up rule to a $5 round-up rule.

Saving with Qapital became addicting, and I’d check my account obsessively, every day, to see if I could round up a goal to a milestone by manually transferring an extra $5 or $10. In the spring, I started freelancing on the side as much as possible to build up my clips, establish relationships with publications I’d want to write for long-term, and save enough to quit.

I created a new goal for taxes, for a third of what I made from assignments, and I put nearly all of the rest into other Qapital savings goals. Instead of spending my extra cash on eating out or new clothes, I funneled every extra penny into my Qapital savings.

Within just seven months, I saved over $9,000. A little more than half of that came from extra income outside of my regular job, and the rest was from filing away all the extra money I could. I used IFTTT, for example, to save $5 with one tap every time I avoided spending money on non-essential purchases.

With a safety net I finally felt comfortable with, I put in my notice in late July, and started freelancing full-time in mid-September. It’s a little early to know how successful I’ll be in the long term, but I do know that if every month is like this one, I’ll be just fine.

Kassondra Cloos is a freelance adventure travel and outdoor writer based in Boulder, Colorado. Follow her on Twitter and Instagram at @kassondracloos, and find more of her work at kassondracloos.com.

Put money in its place

Master your money with the app that makes it easy to divvy up every dollar so you can balance what you want with what you need.

Create account

Share